Content

Which brochure will bring earliest details about the sorts of membership you to is actually covered, publicity limits, and exactly how the newest FDIC assures your finances if the bank fails. No deposit bonuses is actually generally free, because they do not require you to invest anything. Yet not, they come with many regulations and you can constraints that make it somewhat tough to indeed change the newest 100 percent free added bonus for the real money one might be cashed out. Therefore, whether to consider him or her “totally free money” or otherwise not relies on your looks from the it. Even if no-deposit incentives are put as an easy way to market an on-line gambling establishment and you can draw in the newest players to test it, certain gambling enterprises also can render free incentives to present participants because the a type of award due to their commitment. Once you allege a no deposit incentive, you always must meet up with the wagering standards.

Once you discover an expression put, you agree on mortgage loan initial and you will know precisely how far you’ll discovered on your own account after the term. That it predictability is generally beneficial to have traders looking for protected efficiency on their savings. Unlike additional investment alternatives, name places make use of protection from Australian Government’s Financial States System, called government entities ensure. It safeguard means your own identity deposits which have Authorised Put-delivering Institutions (ADIs) are secured to the value of $250,one hundred thousand for each and every membership manager for each ADI, delivering a safety net regarding the uncommon enjoy that supplier would be to go under. The fresh prohibition up against inurement to insiders is absolute; thus, any number of inurement is, potentially, cause of loss of tax-exempt reputation.

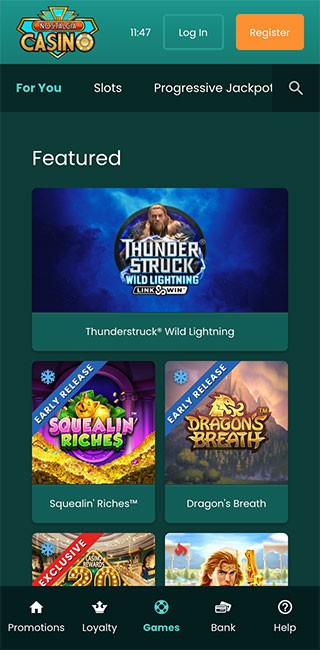

Really local casino incentives – as well as no-deposit also offers – come with some laws and regulations and you can limits. If you don’t, the newest casino will confiscate your incentive and hardly any money your manage to win of it. If you plan to make a free account at the a different online gambling enterprise that offers a welcome no-deposit bonus, chances are high it would be waiting for you on your account once you finish the subscription procedure. The advantage is activated automatically and you can ready for you to start to play.

Book a no cost, no-obligations meeting to suit your money spent or earliest home now!

Through the years, there is certainly a constant and you can sluggish rise in look at this web site its use up until 2019, if you have an obvious increase on account of a regulatory changes, as the might possibly be chatted about afterwards on this page. A lot more striking, yet not, is the highest escalation in 2023 due to the fresh financial disorder one spring season. So it raise try centered in the advanced-sized banking institutions, the class of banking institutions most impacted by spring 2023 financial operates. In the 2024, a majority of You banks are participants inside a network, and lots of of these utilize it. IntraFi states you to 64 % people banks take part in the system.dos Depending on the Call Report, forty two per cent of us commercial financial institutions got a confident quantity of reciprocal dumps after 2023.

Instead of with a certification out of Put, the genuine APY inside the a cost savings can vary in case your speed changes. A knowledgeable Citibank fixed put rate you could potentially already score are step 1.40% p.an excellent. For at least deposit amount of $10,100 and you can a connection chronilogical age of 3 otherwise six months. If or not we would like to hide your hard earned money to possess 3, six or 12 months, we’ve resolved the best fixed deposit rates for your requirements.

That have organizations inside the Cleveland, Cincinnati, and Pittsburgh, we serve a place one to comprises Kansas, west Pennsylvania, east Kentucky, and the north panhandle from Western Virginia. The intention of our work is to bolster the commercial overall performance of the country and you may our area. The fresh acetic acid’s absolute antibacterial services give ACV certain surface health advantages. Utilized externally, it may do areas or flakiness; however, warning becomes necessary on account of potential frustration.

The brand new FDIC adds along with her all deposits inside later years membership mentioned above belonging to the same people in one covered bank and you can makes sure the quantity up to a maximum of $250,one hundred thousand. Beneficiaries might be entitled throughout these membership, however, that does not increase the amount of the brand new put insurance exposure. The fresh FDIC brings separate insurance coverage to possess financing depositors have in numerous types of court possession. All the rental places will be kept from the landlord on the tenant, who’s a party to the contract, in the a bank otherwise offers and you may financing connection or borrowing from the bank relationship that is insured because of the a company of your authorities. Rental places should never be commingled for the personal fund out of the brand new property manager. Regardless of the fresh conditions of part 543B, the rental deposits may be kept inside the a confidence membership, which can be a familiar believe membership and which are an attraction-influence membership.

Nonprofit business one run a restaurant and cafe removed away from its taxation-excused status because of the Irs

Inside old-fashioned banking, the lending company will not make use of rising prices. How will then be Musharaka al-Mutanaqisa going to target the attention part of the payment out of debtor to your financial. The concept of name here next becomes crucial, while the Islamic lender have a tendency to still build the bucks to find our home, but the lender have a tendency to buy the home together with the new resident. With her the bank plus the borrower can be “tenants in common” as well as the regional recorder office will teach both the bank and you can the buyer since the combined citizens. The new part of possession of the house yet usually become according to money ratio between bank and you may client.

Specific bonuses want tall balances otherwise specific direct put minimums. Definitely browse the fine print prior to signing up for a merchant account to confirm you’ll actually manage to get the main benefit. 4Early access to lead put finance is dependant on the brand new time in which i discovered notice of upcoming fee in the Government Reserve, which is usually around two days before booked percentage go out, but could are very different.

Use this research to compare the newest noted totally free gambling establishment incentive offers and pick your favorite. Australia’s a home surroundings is actually typing a new stage inside 2026, buoyed by a complicated blend of chance and challenge. Because the rates of interest begin to slide, have remains strict, and you may populace development nonetheless fuels consult, but consumers, investors, and you will homeowners the exact same face market designed by moving forward affordability, coverage intervention, and developing economic headwinds. This short article breaks down the brand new housing market forecast to possess 2026, exploring the forces at the job, where prices are supposed, the chance for various urban centers and property brands, and just how proper choices may make all the difference from the many years to come. For individuals who’re also looking for a close exposure-totally free investment auto, you’lso are destined to came across fixed places, Singapore Savings Securities (SSB) and Treasury debts (T-bills). A big advantage to RHB’s repaired deposit is they don’t ask you for any punishment payment to own early withdrawal.

Your own lender you are going to offer additional money-protecting benefits, such fee waivers or deal mortgage rates. Banking companies always deposit the main benefit currency within per week to help you a great few months once you meet the offer standards. If you’re also a current customers, you are disqualified, specifically if you recently obtained some other added bonus. On the $525 deals incentive, you need to deposit $twenty five,000 and keep maintaining one to balance to have ninety days, to make their energetic APY 8.67%. The brand new active APY with this extra give is much greater than finest family savings rates — ranging from 4.5% to help you 5.5% — which means this bonus will probably be worth desire.

The business didn’t provide a specific code away from philosophy and you will discipline on the relaxed behavior of one’s congregants. As previously mentioned more than, the company did not document the new mentioned issues, financials, programs, and you can monetary accounts since it states all the paperwork perished inside the a precipitation. The new Internal revenue service have accepted you to definitely “no single grounds is managing, even when all the fourteen may possibly not be highly relevant to certain devotion.” These types of criteria have been acknowledged by lots of courts. The us Ultimate Courtroom have noted you to “the good range in the chapel design and you will company among religious communities inside nation .

Once you’ve compared a selection of label put choices due to assessment equipment, such identity put dining tables and term put calculators, you can start the application process. Compensation of money inside the an enthusiastic inmate’s prepaid service cell phone membership will be install from the calling Assistance support service. From August to 30 Sep 2025, earn focus as much as dos.15% a-year (a supplementary 0.15% per year) once you deposit at the least S$8,one hundred thousand month-to-month (unlike S$step three,000) on the Biggest Dividend+ Checking account making no withdrawals to the day.

The other difference is the fact that the monthly payments because of the client within the Islamic banking try lease and you will relationship buyout payments, rather than return of prominent and attention because they are in the traditional financial. Economically next, the brand new Islamic bank along with offers on the danger of house really worth dropping, in which on the old-fashioned banking design the bank have not pulled any risk of disheartened philosophy. The contrary is valid along with, in which both Islamic financial plus the client obtain if the house comes for over the ebook worth of the partnership.